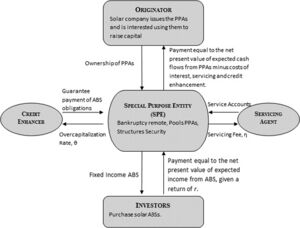

Limited access to low-cost financing is an impediment to high-velocity technological diffusion and high grid penetration of solar photovoltaic (PV) technology. SecuritizationW of solar assets provides a potential solution to this problem. This paper assesses the viability of solar asset-backed securities (ABS) as a lower cost financing mechanism and identifies policies that could facilitate implementation of securitization. First, traditional solar financing is examined to provide a baseline for cost comparisons. Next, the securitization process is modeled. The model enables identification of several junctures at which risk and uncertainty influence costs. Next, parameter values are assigned and used to generate cost estimates. Results show that, under reasonable assumptions, securitization of solar power purchase agreements (PPA) can significantly reduce project financing costs, suggesting that securitization is a viable mechanism for improving the financing of PV projects. The clear impediment to the successful launch of a solar ABS is measuring and understanding the riskiness of underlying assets. This study identifies three classes of policy intervention that lower the cost of ABS by reducing risk or by improving the measurement of risk: (i) standardization of contracts and the contracting process, (ii) improved access to contract and equipment performance data, and (iii) geographic diversification.

Highlights[edit | edit source]

- Limited access to low-cost financing is hampering penetration of solar PV.

- Solar asset-backed securities (ABS) provide a low cost financing mechanism.

- Results for securitization of solar leases and power purchase agreements (PPA).

- Securitization can significantly reduce project financing costs.

- Identifies policy intervention that lower cost of ABS by reducing risk.

See also[edit | edit source]

External Links[edit | edit source]

- Theresa Alafita & Joshua Pearce. Standardization Key to Cutting Solar Funding Costs. Asset Securitization Report, March 28, 2014.

- SolarCity, NYT

- Mosaic

In the News[edit | edit source]

- Solar securities may offer major investment potential - PV Magazine, Finanznachrichten.de

- PPA securitization a new way to invest in solar- Sunwize

- Study Shows Securitization Can Lower the Cost of Capital of Solar PV - Clean Energy Finance Forum, Renewable Energy World

- Unlocking Solar Energy’s Value as an Asset Class - Renewable Energy World, direct link