Methods for Analyzing the Benefits and Costs of Distributed Photovoltaic Generation to the U.S. Electric Utility System[edit | edit source]

This report examines the methods to estimate the value of DGPV. The report classifies the sources of DGPV benefits and costs into the following categories

- Energy- The report proposes 5 approaches given below to calculate the avoided energy cost

[1] Simple avoided generator—assumes PV displaces a typical "marginal" generator, such as a combined-cycle gas turbine (CCGT) with a fixed heat rate

[2] Weighted avoided generator—assumes PV displaces a blended mix of typical "marginal" generators, such as a CCGT and combustion turbines (CTs)

[3] Market price—uses system historic locational marginal prices (LMPs) or system marginal energy prices (system lambdas) and PV synchronized to the same year

[4] Simple dispatch—estimates system dispatch using generator production cost data

[5] Production simulation—simulates marginal costs/generators with PV synchronized to the same year.

- Environment- This mainly deals with the cost of avoided emissions that may occur depending on the generating source

- T & D losses- This basically depends on the location of the DGPV. Again some of the proposed methods are

[1] Average combined loss rate—assumes PV avoids an average combined loss rate for both T&D

[2] Marginal combined loss rate—modifies an average loss rate with a non-linear curve-fit representing marginal loss rates as a function of time

[3] Locational marginal loss rates—computes marginal loss rates at various locations in the system using curve-fits and measured data

[4] Loss rate using power flow models—runs detailed time series power flow models for both T&D.

- Generator capacity-Estimating the generation capacity value of DGPV requires calculating the actual fraction of a DGPV system's capacity that could reliably be used to offset conventional capacity and also applying an adjustment factor to account for T&D losses. The report discusses the following four methods for estimating generation capacity value:

- Capacity factor approximation using net load—examines PV output during periods of highest net demand

- Capacity factor approximation using loss of load probability (LOLP)—examines PV output during periods of highest LOLP

- Effective load-carrying capacity (ELCC) approximation (Garver's Method)—calculates an approximate ELCC using LOLPs in each period

- Full ELCC—performs full ELCC calculation using iterative LOLPs in each period.

- T & D capacity- DGPV can affect both the congestion and the reliability of the system. The report covers the following three methods for estimating transmission capacity value:

- Congestion cost relief—uses LMP differences to capture the value of relieving transmission constraints

- Scenario-based modeling transmission impacts of DGPV—simulates system operation with and without combinations of DGPV and planned transmission in a PCM

- Co-optimization of transmission expansion and non-transmission alternative simulation—uses a transmission expansion planning tool to co-optimize transmission and generation expansion and a dedicated power flow model to evaluate proposed build-out plans.

The report describes the following six methods for estimating distribution capacity value:

- PV capacity limited to current hosting capacity—assumes DGPV does not impact distribution capacity investments at small penetrations, consistent with current hosting capacity analyses that require no changes to the existing grid

- Average deferred investment for peak reduction—estimates amount of capital investment deferred by DGPV reduction of peak load based on average distribution investment costs

- Marginal analysis based on curve-fits—estimates capital value and costs based on nonlinear curve-fits; requires results from one of the more complex approaches below

- Least-cost adaptation for higher PV penetration—compares a fixed set of design options for each feeder and PV scenario

- Deferred expansion value—estimates value based on the ability of DGPV to reduce net load growth and defer upgrade investments

- Automated distribution scenario planning (ADSP)—optimizes distribution expansion using detailed power flow and reliability models as sub-models to compute operations costs

- Ancillary services- These services are required to maintain the reliability of the grid. It mainly includes voltage control and operating reserves. Three methods are discussed to estimate theses services

- Assume no impact—assumes PV penetration is too small to have a quantifiable impact

- Simple cost-based methods—estimates change in ancillary service requirements and applies cost estimates or market prices for corresponding services

- Detailed cost-benefit analysis—performs system simulations with added solar and calculates the impact of added reserves requirements; considers the impact of DGPV providing ancillary services

- Other factors- These mainly deal with the fuel price uncertainty and also reduction in energy prices when DGPV is connected to grid

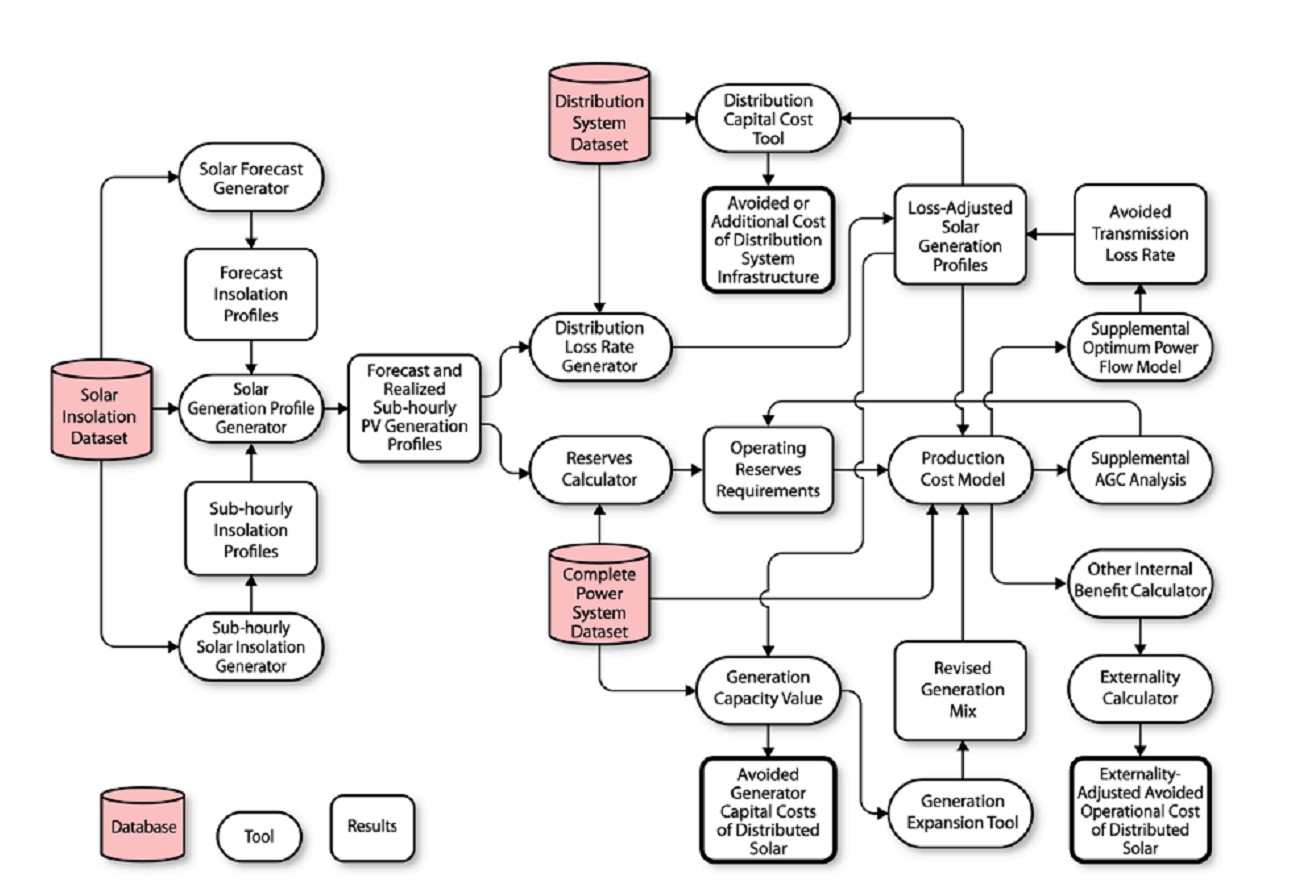

The report provides a possible framework to work with to calculate each of the parameters. The figure gives a very precise idea to utilities ,stakeholders and parties involved on how to develop a framework that would quite accurately determine the value of solar.

The Value of Distributed Solar Electric Generation to New Jersey and Pennsylvania[edit | edit source]

In this report the VOS analysis is done at seven locations, four in Pennsylvania and three in New Jersey. These locations were chosen because they differ in generation mix and this would be reflected in the different environmental costs. Also they differ in the solar radiation levels. Each location was studies for four types of PV configurations which are as follows

- South-30 (fixed)

- Horizontal (fixed)

- West-30 (fixed)

- 1-Axis (tracking at 30-degree tilt)

This provided a difference in the solar production levels and hence were reflected in the capacity avoided cost and also the energy costs avoided. The detailed calculations as to how the numbers were obtained is also explained in this paper. Some of the key takeaways and conclusions were as follows

[1] Total Value :This value varied from 256/ MWh to 318/MWh

[2] Energy Value: This mainly consists of the fuel cost savings and the operation and maintenance cost saving when a PV system is used in place of a conventional power plant (Typically a combined cycle gas turbine )

[3] Strategic Value: This is mainly the security value that a DPV system brings as it is not concentrated at one place. It also includes the Long term value that it brings to the society at large

[4] Market Price reduction: The highest values were obtained in locations where there was a very good match between the Location Marginal Price (LMP) curve and the PV output curve

[5] Environmental Value: This too varied depending on the types of generation the PV was to be replaced with

[6] T & D capacity Value: The values were fairly low as the study only takes into consideration the infrastructure capital that would be deferred for a future time and not immediate investment that would be saved

[7] Fuel Price Hedge: This value essentially determines the future avoided purchases of fuel. So the value greatly depends on the studies utilities or integrated resource planning

[8] Generation capacity Value: As there is a moderate match between the PV output and the load, this value is typically taken between 28-45% of the rated PV output

[9] Economic Development Value: PV generation provides local jobs at higher rates than conventional generation

[10] Solar Penetration Cost: As the solar market penetration increases, more and more infrastructure would be required to synchronize it with the grid. This is actually an estimated expense and hence it is given a negative value

Environmental impacts from the solar energy technologies[edit | edit source]

Environmental impacts from the solar energy technologies

Environmental impacts from solar energy technologies

This paper basically talks about the impacts that solar energy production potentially has, positive and negative. The positive effects of solar technology are always more propped up and talked about. There is not much discussion about its negative repercussions on the environment. This paper tries to rectify that missing component in the discussion around solar energy. It discusses the impacts of Solar PV and Solar thermal technologies. Some of the negative impacts of using solar energy on the environment are as follows :

• Visual Impact

• Routine and accidental release of chemicals

• Land use

• Work safety and hygiene

• Effect on ecosystem

• Impact on water resources

However, all these problems can be overcome by proper site selection, design, innovation and focus on health and safety. The negative impacts of solar technologies are far lesser than that of conventional generation methods.

Impacts of High Solar Penetration in the Western Interconnection[edit | edit source]

This paper gives a very detailed study of how solar penetration levels greatly impacts the interconnected grid. As more and more solar generation is being employed, its impact on the existing infrastructure also becomes important. It also examines if it is economically feasible for the western grid to accommodate more levels of solar penetrations. Typical studies are done for 5 % and 25 % solar penetration levels. The paper shows the day daily, seasonal and annual characteristics of Concentrating solar power (CSP) and Photovoltaic Solar (PV) for the areas considered in the study. It is seen that the CSP has a profile which is closer to the load profile. One key finding is that the variable cost goes down as solar penetration reaches 25 %. This is obvious because this is the value of the fuel that is being displaced. However, the operational cost reductions tend to go up as the solar penetration levels increases. This is due to the fact that additional solar power means additional capital investment. The generation being fixed we are just adding an extra source into the system, which ultimately is being added to the cost of the solar energy.

Effect of Penetration on Capacity Value

The capacity value of solar decreases with increased penetration. This is because when an adequate system is fed with more power from a similar source, it gives diminishing returns

Key Findings

The key finding of the study is that the western grid can accommodate 25% solar penetration if the following changes could be made over time • More transmission utilization

• A more thorough unit commitment and economic dispatch of the generators

• Develop very accurate forecasting mechanisms for solar power

• Build more transmission infrastructure as the renewable energy expands

• Detailed study and commitment of adequate operating reserves

• Increase the flexibility of the existing generators

Electricity Rate Structures and the Economics of Solar PV:Could Mandatory Time-of-Use Rates Undermine California’s Solar Photovoltaic Subsidies?[edit | edit source]

Borenstein S. Electricity Rate Structures and the Economics of Solar PV: Could Mandatory Time-of-Use Rates Undermine California’s Solar Photovoltaic Subsidies?. Center for the Study of Energy Markets. 2007 Sep 17. This paper evaluates the validity of the claim that Time Of Use (TOU) tariff caused the orders for solar installations by 78 % as published in the Los Angeles Times in May 2007.

In January 2007, there was a requirement for solar customers to switch to the TOU tariff from the fixed rate tariff. The paper does a thorough study of customers from two of the biggest utilities in California, Pacific Gas and Electric (PG&E) and Sothern California Edison (SCE). The paper does a calculation of the bills the customers would get. It initially calculated the bill under the fixed tariff mechanism and then with the TOU mechanism. Then the bill is calculated taking into consideration a 2 KW solar generation. The author makes various assumptions in these calculations. One critical aspect was that the TOU scheme was not the same in the two utilities. TOU is a mechanism where the price of electricity varies according to the demand and the time of the day. The fixed rate tariff is a tiered tariff mechanism where customers under a particular total consumption will pay a fixed amount as their bill.

Results

The study showed that the TOU tariff was in fact working more efficiently from the economic point of view for PG&E customers. The bills of these customers with and without a solar generation was lesser as compared to the fixed tariff bills. However, SCE has a somewhat complex TOU tariff mechanism. They implement two different TOU schemes, one for customers with annual consumption of 4800-7200kWh (medium sized), and the other for customers with an annual consumption of more than 7800kWh (large sized). Now here to calculate the bills under such complex tariff schemes the author makes some valid assumption. The results however, show that for SCE customers with lower consumption, the fixed tariff scheme is better. While SCE customers with higher consumption will benefit from the TOU scheme. The paper however, clearly states that this has nothing to do with the decrease in solar orders. This is only because of some weird TOU tariff scheme that SCE is employing.

The paper concludes that the claims by Los Angeles Times are unsubstantiated and there could be a variety of different economic and social factors as well as comparing of wrong sets of data sets that may have caused them to come up with such a report.

Combined Optimal Retail Rate Restructuring and Value of Solar Tariff[edit | edit source]

Negash AI, Kirschen DS. Combined optimal retail rate restructuring and value of solar tariff. InPower & Energy Society General Meeting, 2015 IEEE 2015 Jul 26 (pp. 1-5). IEEE. This paper proposes a new approach to value solar power. It discusses about the problems with net metering as the number of solar customers are increasing. It also describes the Value of Solar approach and the potential downsides it has.

Three Part Retail Rate

The author proposes a new optimized retail rate called the three part retail rate. This attempts to recover variable costs and fixed costs of generation. Here energy cost is considered variable and customer costs is fixed. Also and additional variable charge is assumed for the demand.

Weighted Retail Rate VOST

It is proposed that the value of solar be linked to the proportion of each of the utilities cost components. Each of these cost components would be weighted by a factor that represents the efficacy of the distributed solar to reduce those costs. An optional external component rate ‘v’ could be added to the weighted retail rate.

VOST = (reng X w1) + (rdmd X w2) + (rcust X w3) + v

Where, reng ,rdmd and rcust are the utility’s energy, demand and customer cost components respectively of the retail rate and w1, w2 and w3 are the PV owner’s energy, demand and customer cost weights respectively.

A case study was done on a medium sized utility using the proposed approach and the results were found to be quite efficient and accurate. The increasing penetration of solar energy will force stated into making policies which are more fair and accurate. The techniques employed in this paper may be a way to go.

Valuing Distributed Energy: Economic and Regulatory Challenges[edit | edit source]

Valuing distributed energy: economic and regulatory challenges

- The advancements and cost reductions in solar panels, smart meters and battery storage is facilitating cost reductions and smarter infrastructure. Solar can benefit the customers and the power system is an accepted fact but at the same time there are concerns about valuation, integration and operational cost allocation and recovery.

- Following major concerns are addressed in the paper

- Starting a dialogue between all the stake holders in this.

- Why is there a need of new valuation approach.

- Explain the various benefits and costs of generation.

- How to measure the benefits by solar generations.

- For sure all the distributed energy resources do one thing and i.e.reduce or shift the load. This alone creates economic tensions in the system.

- There are many kinds of distributed energy but solar has been the most significant of all because of the drop in cost by 70% over a couple of years, fall in system price by 33% over just 2 years and introduction of third party ownership or leasing.

- Current Valuation methods of solar:

- Public Utilities Regulatory Policy Act 1978 [1] was the starting point of this pricing mechanism. It required utilities to purchase power from customers producing it at avoided cost. Though a lot of utilities contrived through it, but it still is useful in evaluating options for distributed energy pricing and also many new policies use PURPA's legal foundation.

- Proxy Unit Methodology:In this method an assumption is made that utility is avoiding a generating unit by using the solar power from customers. Then the fixed cost of this hypothetical unit becomes the avoided capacity cost and variable cost.

- Peaker Unit Methodology:This assumes that a customer generating by solar energy helps utility avoid paying for marginal generating unit. Here the capacity payment is based on fixed cost of the utilities least cost peaker unit and energy payments are the foretasted payments for a peaker unit over the contract period.

- Differential Revenue Requirement:The difference in cost for a utility with the customer producing by solar.

- Market Based Pricing:Customer with access to markets receive energy and capacity payments at market rates.

- Competitive Bidding:An open bidding process and winning bid is regarded as the utilities avoided cost.

- All the above methods have loop holes and following factors along with the above can be considered in the valuation process:

- Dispatch ability and minimum availability.

- Line loss and avoided transmission costs.

- Environmental cost adders.

- Long term levelized contract rates Vs varying rates.

- Resource Differentiation.

- Location will surely determine the value of energy displaced, capacity and reserve requirements, factors used to determine congestion, loss in the T&D and externalities to be included in the pricing mechanism.

- Short term transactions Vs long term contracts.A long term contract would help in addition of solar PVs over time when compared to short term pricing mechanism.

- Uncertainty and Variability, A solar array paired with storage can reduce the variability and provide value for both customer and utility.

- Pecuniary Vs non-pecuniary costs and benefits, Pecuniary elements are those that have direct cost benefit to someone who is party to the electricity transaction and non pecuniary are the benefits that are outside the transactions.

- Building up a valuation model:

- Choosing the right energy value

- Choosing the right capacity value

- What are the pecuniary costs borne by others?

- What non-pecuniary costs and benefits exist?

Market value of solar power: Is photovoltaics cost competitive?[edit | edit source]

This paper reviews the economics of solar power acting as a source in the interconnected grid.

The costs of solar power have declined very steeply in the past decade. There is a lot of discussion regarding how the economic value of solar should be calculated.

The grid parity technique, comparing generation costs to the retail price, is an often used yet flawed metric for economic assessment, as it ignores grid fees, levies, and taxes.

It also fails to account for the fact that electricity is more valuable at some points in time and at some locations than that at others.

A better yardstick than the retail price is solar power’s ‘market value’.

The paper does a detailed study on how such a market value of solar can be obtained.

A Review of Solar PV Benefit & Cost Studies[edit | edit source]

Solar PV pricing has become a highly debated topic recently because of the growing number of Distributed Solar PV customers. The net metering scheme has not been accepted as fair by some utilities and so all stakeholder in DPV system are looking for alternatives. The Value of Solar (VOS) method is gaining popularity and extensive studies are being done in this regard. In VOS the cost attributed to solar is a combination of various avoided cost if PV is used instead of a conventional power plant.

The VOS is evaluated based on the following costs

• Energy cost

This includes avoided energy due to fuel, operation and maintenance and heat. It also includes the avoided system losses due to the reduced generation capacity and emissions.

• Capacity (generation, transmission and distribution)

This includes the generation avoided and hence the avoided infrastructure upgrades needed.

The DPV capacity is determined through its Effective Load Carrying Capacity (ELCC) , that is the demand that a DPV can cater to when operating at full capacity.

• Grid support services

This includes the reactive power and voltage supply, frequency regulation, energy imbalance and operating reserves.

• Financial risk

This value is positive when the introduction of DPV reduces the financial risk or overall market price. There is a fuel uncertainty value, which is the future uncertainty in fuel cost called the fuel price hedge. There is reduced demand because of lesser dependence on central generation.

• Security risk

There is lesser congestion in transmission and distribution. Only some area is affected when there is an outage of a PV plant. Back service can be kept available during outages.

• Environmental cost

This value is positive when it results in reduction of environmental or health impacts. It also includes a Renewable Portfolio Standard Cost, which is the cost saved through not using some other renewable source.

• Social costs

It results in increase in employment opportunities and accelerates economic development. There is a broad consensus as far as the energy cost avoided is concerned among the stakeholders. There is also some agreement on the capacity value of DPV. The key differences are in evaluating the values of security risk, financial risk, environment, society and grid support.

Why does VOS evaluations differ?

This is predominantly due to the fact that every utility would adopt a different approach to determine each of the components. For example, some may include capacity value in energy price and some may not.

This report hence gives us a framework on how each component of the VOS can be calculated.

An Evaluation of Solar Valuation Methods Used in Utility Planning and Procurement Processes[edit | edit source]

As renewable technologies mature, recognizing and evaluating their economic value will become increasingly important for justifying their expanded use. This paper reviews a recent sample of U.S. load-serving entity (LSE) planning studies and procurement processes to identify how current practices reflect the drivers of solar’s economic value.

General planning process adopted by many LSEs

- Assessment of future needs and resources

- Creation of feasible candidate portfolios that satisfy needs

- Evaluation of candidate portfolio costs and impacts

- Selection of preferred portfolio

- Procurement of resources identified in preferred portfolio

Key take aways

- Full evaluation of the costs & benefits of solar requires that a variety of solar options are included in diverse set of candidate portfolios

- Design of candidate portfolios, particularly regarding the methods used to rank potential resource options, can be improved

- Studies account for the capacity value of solar, though capacity credit estimates with increasing penetration can be improved

- Most LSEs have the right approach and tools to evaluate the energy value of solar. Improvements remain possible, particularly in estimating solar integration costs used to adjust energy value

- T&D benefits, or costs, related to solar are rarely included in studies

- Few LSE planning studies can reflect the full range of potential benefits from adding thermal storage and/or natural gas augmentation to CSP plants

- The level of detail provided in RFPs is not always sufficient for bidders to identify most valuable technology or configurations

]