As energy demands continue to grow, so too does the debate over the future of energy supply. As such, nuclear technology is often pitted against renewable sources such as solar photovoltaic (PV) technology through comparisons of energy capacity, life cycle, GHG emissions and economic performance. The economic arguments in particular are distorted and heavily defined by subsidies to nuclear industry - these can be in the form of direct and indirect subsidies. Our focus was to evaluate the effects of indirect subsidies - such as the nuclear insurance liability subsidy, and compare energy returns if a subsidy of the same magnitude was diverted instead to the solar photovoltaic industry.

Publications[edit | edit source]

- ---

- I. Zelenika-Zovko and J. M. Pearce, "Diverting Indirect Subsidies from the Nuclear Industry to the Photovoltaic Industry: Energy and Economic Returns", Energy Policy 39(5):2626-2632 (2011). open access

- J.M. Pearce, "Increasing PV Velocity by Reinvesting the Nuclear Energy Insurance Subsidy into Large Scale Solar Photovoltaic Production", Photovoltaic Specialists Conference (PVSC), 2009 34th IEEE, pp.1338-1343, 7-12 June 2009. open access

- ---

Popular summary:

- Joshua Pearce, "The Risks of Politicizing Energy: Nuclear vs Solar"InterPV May 2011, pp. 28-30.

Background[edit | edit source]

While it is well established that nuclear power is a heavily subsidized industry, one aspect of nuclear subsidization is rarely included in analysis because it is difficult to quantify: the indirect insurance liability subsidy. Currently in the US, the collective liability cap for the industry $10 billion. Should an accident exceed that amount the Government would step in to cover the exceeding costs. As such, a cap on insurance liability represents an indirect subsidy because it reduces the costs of nuclear energy and without it no nuclear power plant could be built.

The assumptions used in the analysis include:

- Based on the studies by Dubin and Rothwell (1990) and Heyes and Liston-Heyes (1998) estimate of the nuclear insurance liability through Price Anderson Act is valued at $33 million dollars (2001 dollars) per reactor per year. Therefore, value of the nuclear insurance liability subsidy in the US = $33 million per GW NPP/year. It should be noted this value was not increased for inflation to remain conservative.

- The amount of nuclear reactors in the US = 104

- The cost to build 1 GW/yr solar PV fabrication plant = 2.4 billion dollars

- Time lag to allow for the PV fab to go into production = 1 year

- NPP operating at 90% of the time

- PV panels operating at 5 sun hours/ day (21% utilization, 1% degradation)

- United States Nuclear Regulatory Commission database used to calculate reactors going out of commission

Objective: compare energy and financial returns over years between the solar PV and nuclear industries funded by the same indirect subsidy (loan guarantee for solar and insurance subsidy for nuclear).

Results[edit | edit source]

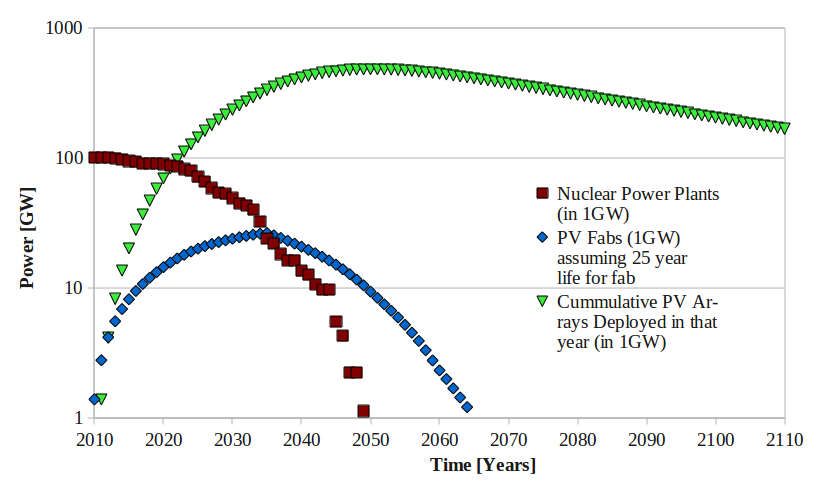

The preliminary analysis indicates that if only this one relatively ignored indirect subsidy for nuclear power was diverted to photovoltaic manufacturing, it would result in more installed power and more energy produced by mid-century compared to the nuclear. By 2110 cumulative electricity output of solar would provide an additional 48,600 TWh of energy over nuclear. At current national average cost of electricity of $0.11/kW, this additional energy is worth $5.3 trillion.

The results clearly show that not only does the indirect insurance liability subsidy play a significant factor for the viability nuclear industry, but also how the transfer of such an indirect subsidy from the nuclear to photovoltaic industry would result in more energy and more financial returns over the life cycle of the technologies. The energy results alone indicate renewable alternatives are a more viable option, let alone when other shortcomings and risks of nuclear power are added to the list: high construction costs, security and proliferation risks as well as the problems with the long term nuclear waste management.

Future Work: Case for Canada[edit | edit source]

As no actual research data exists yet for Canadian nuclear insurance liability estimates, we could not successfully quantify the amount of the liability subsidy. However, given that nuclear insurance pool in Canada is lower than in the US, we can postulate that the nuclear liability subsidy is even higher than in the US.This needs to be investigated in the future.

In the press[edit | edit source]

- CTV News Channel

- Solar power outshines nuclear power: Study -Toronto Star

- Solar Power Trumps Nuclear Energy: University Study - Energy Matters

- CBC Newsworld's Power and Politics

- Research with Real-World Implications

- Nuclear Not Worth the Risk -Toronto Sun

- We tried the nuclear power experiment -- and it didn't work -Kingston Whig-Standard

- Uranium Processor Still Optimistic About Nuclear Industry -New York Times

- Building more reactors in wake of Japan disaster doesn't make sense, say some -- CBC News

- The Nuclear Cost Shell Game --Inter Press Service

- Canadees onderzoek: Kernenergie is geldverspilling (Canadian research: Nuclear power is a waste)- Reformatorisch Dagblad (Dutch Reformed Daily)

- Belastingbetaler krijgt rekening van nucleaire ramp (Taxpayers will be nuclear disaster) - Gazet Van Antwepen

- Fukushima disaster puts focus on hidden subsidies to nuclear power Global Subsidies Initiative

- Limited Liability – Nuclear Energy's 'Mother of all Subsidies' - Transcend

- Former US president Bill Clinton used US nuclear and coal plants as an example of unequal financing in the energy sector: "In the US if you want to build a nuclear power plant you get 30 years to pay for it with guaranteed rates from the consumers, and since no insurance company will insure one, the government basically insures the whole operation – that's a massive subsidy." [1]