M. Urquhart (talk | contribs) m (Created page with ''''Notes on IRR Calculation:''' In order for an internal rate of return (IRR) to be calculated, the cash flow in at least one period studied should be negative. IRR is the inter…') |

M. Urquhart (talk | contribs) mNo edit summary |

||

| Line 1: | Line 1: | ||

'''Notes on IRR Calculation:''' | '''Notes on IRR Calculation:''' | ||

In order for an internal rate of return (IRR) to be calculated, the cash flow in at least one period studied | In order for an internal rate of return (IRR) to be calculated, the cash flow in at least one period studied must be negative. The IRR is the interest rate at which the sum of all net cash flows sums to zero over the given study period. If all of the cash flows are positive, the function never converges in Excel and instead returns the error, "#NUM!", effectively meaning an infinite IRR results. | ||

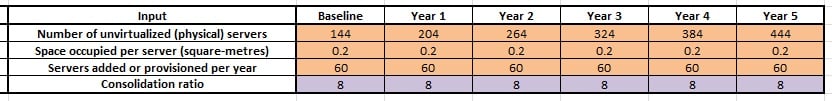

<u>Example</u>: If the consolidation ratio (the number of virtual servers per physical server) is changed with all other inputs held constant and an initial guess of 1 for the IRR function, we can see that the IRR is calculating for certain cases: | <u>Example</u>: If the consolidation ratio (the number of virtual servers per physical server) is changed with all other inputs held constant and an initial guess of 1 for the IRR function, we can see that the IRR is calculating for certain cases: | ||

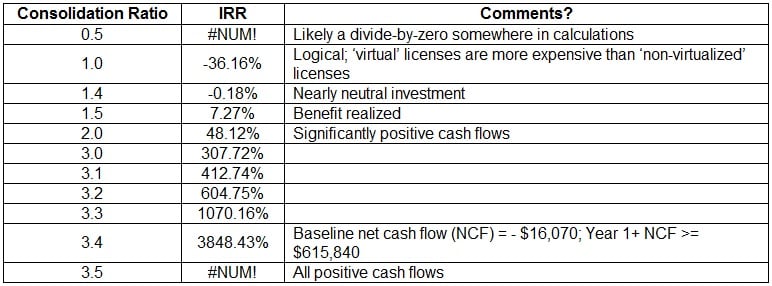

[[Image:IRR calculations.jpg|center]]Note that these results were obtained using the default input values: | [[Image:IRR calculations.jpg|center]]Note that these results were obtained using the default input values: | ||

[[Image:Default inputs.jpg|center]] | [[Image:Default inputs.jpg|center]] | ||

Revision as of 06:36, 15 December 2010

Notes on IRR Calculation:

In order for an internal rate of return (IRR) to be calculated, the cash flow in at least one period studied must be negative. The IRR is the interest rate at which the sum of all net cash flows sums to zero over the given study period. If all of the cash flows are positive, the function never converges in Excel and instead returns the error, "#NUM!", effectively meaning an infinite IRR results.

Example: If the consolidation ratio (the number of virtual servers per physical server) is changed with all other inputs held constant and an initial guess of 1 for the IRR function, we can see that the IRR is calculating for certain cases:

Note that these results were obtained using the default input values: