J.M.Pearce (talk | contribs) m (→Media Coverage) |

J.M.Pearce (talk | contribs) |

||

| (One intermediate revision by the same user not shown) | |||

| Line 5: | Line 5: | ||

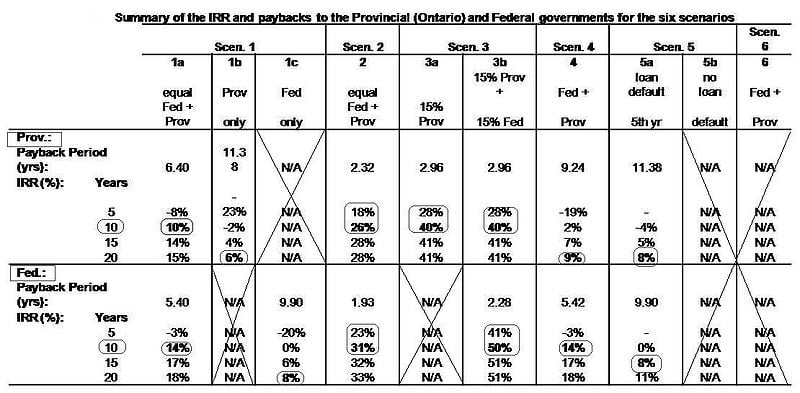

As the Ontario government has recognized that solar photovoltaic (PV) energy conversion is a solution to satisfying society's energy demands while reducing the adverse anthropogenic impacts on the global environment that compromise social welfare, they have begun to generate policy and funding programs to support financial incentives for PV. This paper (publication below) provides a financial analysis for investment in a 1 GW per year turnkey amorphous silicon PV manufacturing plant. The financial benefits for both the provincial and federal governments were quantified for: i) full construction subsidy, ii) construction subsidy and sale, iii) partially subsidize construction, iv) a publicly owned plant, v) loan guarantee for construction, and vi) an income tax holiday. Revenues for the governments are derived from: taxation (personal, corporate, and sales), sales of panels in Ontario, and saved health, environmental and economic costs associated with offsetting coal-fired electricity. Both governments enjoyed positive cash flows from these investments in less than 12 years and in many of the scenarios both governments earned well over 8% on investments from 100s of millions to $2.4 billion. The results showed that it is in the financial best interest of both the Ontario and Canadian federal governments to implement aggressive fiscal policy to support large-scale PV manufacturing. | As the Ontario government has recognized that solar photovoltaic (PV) energy conversion is a solution to satisfying society's energy demands while reducing the adverse anthropogenic impacts on the global environment that compromise social welfare, they have begun to generate policy and funding programs to support financial incentives for PV. This paper (publication below) provides a financial analysis for investment in a 1 GW per year turnkey amorphous silicon PV manufacturing plant. The financial benefits for both the provincial and federal governments were quantified for: i) full construction subsidy, ii) construction subsidy and sale, iii) partially subsidize construction, iv) a publicly owned plant, v) loan guarantee for construction, and vi) an income tax holiday. Revenues for the governments are derived from: taxation (personal, corporate, and sales), sales of panels in Ontario, and saved health, environmental and economic costs associated with offsetting coal-fired electricity. Both governments enjoyed positive cash flows from these investments in less than 12 years and in many of the scenarios both governments earned well over 8% on investments from 100s of millions to $2.4 billion. The results showed that it is in the financial best interest of both the Ontario and Canadian federal governments to implement aggressive fiscal policy to support large-scale PV manufacturing. | ||

'''Source:''' K. Branker and J. M. Pearce, “[http://dx.doi.org/10.1016/j.enpol.2010.03.058 Financial Return for Government Support of Large-Scale Thin-Film Solar Photovoltaic Manufacturing in Canada]”, ''Energy Policy'' '''38''', pp. 4291–4303 (2010). [http:// | '''Source:''' K. Branker and J. M. Pearce, “[http://dx.doi.org/10.1016/j.enpol.2010.03.058 Financial Return for Government Support of Large-Scale Thin-Film Solar Photovoltaic Manufacturing in Canada]”, ''Energy Policy'' '''38''', pp. 4291–4303 (2010). [http://mtu.academia.edu/JoshuaPearce/Papers/1540699/Financial_Return_for_Government_Support_Financial_Return_for_Government_Support_of_Large-Scale_Thin-Film_Solar_Photovoltaic_Manufacturing_in_Canada Open access] | ||

==Major Findings== | ==Major Findings== | ||

Revision as of 17:34, 21 May 2012

Financial Return for Government Support of Large-Scale Thin-Film Solar Photovoltaic Manufacturing in Canada

Abstract: As the Ontario government has recognized that solar photovoltaic (PV) energy conversion is a solution to satisfying society's energy demands while reducing the adverse anthropogenic impacts on the global environment that compromise social welfare, they have begun to generate policy and funding programs to support financial incentives for PV. This paper (publication below) provides a financial analysis for investment in a 1 GW per year turnkey amorphous silicon PV manufacturing plant. The financial benefits for both the provincial and federal governments were quantified for: i) full construction subsidy, ii) construction subsidy and sale, iii) partially subsidize construction, iv) a publicly owned plant, v) loan guarantee for construction, and vi) an income tax holiday. Revenues for the governments are derived from: taxation (personal, corporate, and sales), sales of panels in Ontario, and saved health, environmental and economic costs associated with offsetting coal-fired electricity. Both governments enjoyed positive cash flows from these investments in less than 12 years and in many of the scenarios both governments earned well over 8% on investments from 100s of millions to $2.4 billion. The results showed that it is in the financial best interest of both the Ontario and Canadian federal governments to implement aggressive fiscal policy to support large-scale PV manufacturing.

Source: K. Branker and J. M. Pearce, “Financial Return for Government Support of Large-Scale Thin-Film Solar Photovoltaic Manufacturing in Canada”, Energy Policy 38, pp. 4291–4303 (2010). Open access

Major Findings

Table of Scenarios investigated

| Scenario | Description |

|---|---|

| 1 | 100% Subsidy of construction and give away a: Equal Provincial (Prov.) and Federal (Fed.) investment b:Prov. investment only c: Fed. investment only |

| 2 | Fund construction and sell to private bidders Equal Fed. and Prov.investment |

| 3 | Partially Subsidize construction with funding programs a: 15% subsidy from Prov. only b: 15% subsidy from Prov. with 15% subsidy from Fed. |

| 4 | Publicly owned plant |

| 5 | Loan guarantee for a private company a: loan default in 5th year b: no loan default |

| 6 | Income Tax holiday from Fed. and Prov. |

Summary of findings. Click to see enlarged images.

-

Return for Ontario government

-

Return for Canadian government

Related Research Pages

- Government Investment and PV Manufacturing - Lit. Review

- Government PV Manufacturing Policy Lit Review

Media Coverage

- Solar power manufacturing makes good business sense for governments: Queen's University study,(Eureka Alert) Public release date: 20-May-2010, Michael Onesi

- Governments should support solar power manufacturing: study, 20-May-2010

- Governments Prosper from Solar Power Manufacturing, Renewable Energy World, 21-May-2010

- Solar Power Manufacturing Makes Good Business Sense for Governments, Study Finds Science Daily 20 May, 2010

- Governments should support solar power manufacturing: study ZeroEmission TV (Italy) 21 May , 2010

- Energy developer seeks sunny homes:Firm sells, rents residential solar power units Ottawa Citizen and Montreal Gazette May 25, 2010.

- Government solar finance a winner Daily Commercial News, May 28, 2010.

- Solar panels could power economy Kingston Whig Standard, May 29, 2010.

- Solar Technology Energizing Ontario's World Status Ontario Solar News, June 9, 2010.

- Solar Power Generation: Creating electricity from the sun’s rays will work only with the backing of industry and government Canadian Industrial Machinery Nov. 8, 2010